Proposed US tobacco tax could have ‘game-changing impact’ on nicotine pouches

The price of nicotine pouches in the US could rise by 178%, making them more expensive than cigarettes, if a new US tobacco tax proposal becomes law.

The budget proposal, put forward last month by the Democrat-led House Committee on Ways & Means, includes a large increase in the tobacco Federal Exercise Tax (“FET”).

The levy, which has not been raised since 2009, would for the first time also cover vaping liquids and nicotine pouches.

‘Taxable nicotine’ provision

The proposal includes a “taxable nicotine” provision covering “any nicotine (other than nicotine used in listed tobacco products) that has been extracted, concentrated, or synthesized”.

Should the proposal become law, a can of 20 nicotine pouches with 8mg of nicotine would be subject to a tax hike of $8.90, according to an analysis by the US-based Tax Foundation.

Currently, nicotine pouches are not subject to federal taxes in the US and have an average retail price in the US of $4-6 excluding various state-level tobacco taxes.

The proposal would also raise taxes on snus by an eye-popping 2,892%, according to the Tax Foundation.

Nicotine pouches pricier than cigarettes?

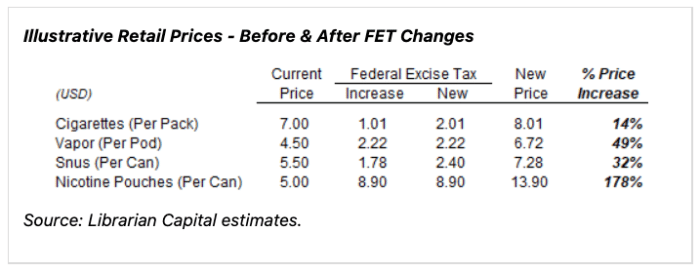

An analysis by Librarian Capital investment firm found that the Democrats’ proposed tax hikes would have a greater impact on the retail prices of less-harmful nicotine products.

While cigarette prices would only increase by 14 percent, the retail price of snus would rise by 32%, with vaping pod prices likely rising by 49%.

The proposal would have the biggest impact on the price of nicotine pouches, which would rise by 178% according to Librarian Capital’s analysis. This would make pouches more expensive than deadly cigarettes despite their much lower health risks.

Speaking with Filter magazine, health economist Michael Pesko from Georgia State University said it makes “little sense to increase taxes on the safer product more”.

“A better strategy from a public health perspective would be to raise taxes on cigarettes more,” he told the magazine.

If enacted, the proposed FET increases would have “a potentially game-changing impact” on nicotine pouch sales volumes in the US, writes Librarian Capital.

The analysis predicted that Swedish Match, the current nicotine pouch market leader in the US, would be a “major loser” if the proposal is passed in its current form.

However, Swedish Match’s head of investor relations, Emmett Harrison, downplayed the potential impact of the US tobacco tax proposal, emphasizing it remained “unclear” what the final proposal might look like.

Denmark also examining nicotine pouch tax hike

Speaking with Swedish financial newswire Direkt, Harrison said that he believed a US tobacco tax hike on nicotine pouches of $8-9 per can was “highly unlikely”.

“It would be counterproductive for efforts to make it easier to migrate away from cigarettes,” he said.

The US isn’t the only country considering new taxes on safer nicotine products. The Danish government is also considering a massive tax hike on nicotine pouches.

The government’s proposal would raise the price of nicotine pouches by about 11 Danish kroner per can. A budget brand can of 20 nicotine pouches currently costs around 30 kroner ($4.60).

The stated aim of the measure is to raise prices to dissuade young people from buying the product. The bill will be considered by the Danish parliament in October with a vote expected before the end of the year.

Subscribe to the Snusforumet newsletter

Subscribers receive instant access to the story behind the EU snus ban by author Christopher Snowdon.

By subscribing to our newsletter, you agree to allowing Snusforumet to use your email address to contact you with news and marketing. materials. Read more about how we process your personal information in our privacy policy.