Swedish Government Moves to Slash Snus Taxes by 20%

The Swedish government has put forward a legislative proposal to the Law Council, suggesting a reduction in snus taxes and an increase in taxes on cigarettes and other tobacco products. These proposals were announced in the 2024 budget proposition.

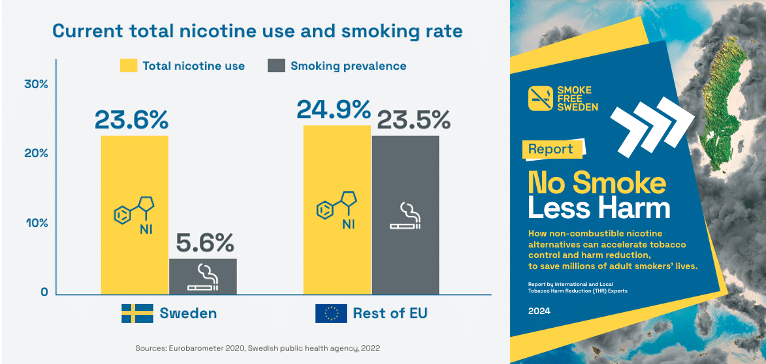

Currently, the tax on snus is lower than that on cigarettes and other smoked tobacco, reflecting the differing health risks associated with these products. In light of this, the government proposes to further reduce the tax on snus by approximately 20 percent. This will result in an expected decrease in the price of a snus can by around 3 kronor.

Oscar Sjöstedt, economic-policy spokesperson for the Sweden Democrats, explains the rationale behind the proposal in a recent press release on the Swedish government’s website, stating, “The health effects vary greatly between snus and cigarettes. It is therefore reasonable to reflect this difference in tax policy, making the healthier alternative approximately three kronor cheaper.”

Additionally, the government suggests raising taxes on most tobacco products, including cigarettes and smoked tobacco, by approximately 9 percent.

Their announcement also explains that due to higher-than-expected inflation in recent times, the 2024 tax rate is lower than it would have been without the last two tax hikes. These increases have not had the intended effect. A higher tax and consequently higher prices on cigarettes and smoked tobacco may help reduce smoking rates.

The government does not propose any changes to the tax on nicotine pouches or e-liquids for vaping. They believe instead that these taxes should be annually adjusted for inflation, as is already the case for tobacco products. This, they say, ensures that the relationship between taxes on tobacco and nicotine remains consistent over time.

The proposal is the result of an agreement between the government and the Sweden Democrats. The effects are planned to take effect on November 1st this year.

“Reducing snus taxes acknowledges its potential for reducing harm compared to other tobacco products, thereby contributing to better public health outcomes. This wise approach isn’t universally accepted yet. Both the EU and Norway might benefit from adjusting their tax policies to support health advantages rather than enforcing complete bans,” says Patrik Strömer, Secretary General of the Association of Swedish Snus Manufacturers.