Column: How should e-cigarettes be taxed? By weight, harm or arbitrarily?

Swedish snus has been around for 200 years, e-cigarettes in their current form were invented during this millennium. Both products share the advantage that users can ingest nicotine without being exposed to harmful cigarette smoke.

It has been scientifically established that snus is significantly less harmful than smoking. And although it is not yet possible to know the long-term effects of using e-cigarettes, or vaping, there is no serious research that suggests that it would be harmful to health to quit smoking and use another source of nicotine.

Reduce harm, not use

Those are the facts and the history. But on these issues, the facts are not enough, at least not if you are a politician. The Swedish government’s strategy on alcohol, drugs, and tobacco states that “tobacco use must be reduced”. That wording has been in place since 2011, and no parliamentary party has yet distanced itself from it or tried to change it.

Of course, a strategy focused on harm reduction would be more reasonable. This is already the case for alcohol, where the government is not against drinking per se, so long as it does not lead to negative consequences.

Excise tax on snus

Both alcohol and tobacco are legal products, although there is an age limit, a lot of regulations, and high excise taxes. But the fact that they are still treated in different ways politically means that the government’s policy for snus is quite complicated.

There is a special tax on cigarettes. Snus also has its very own tax that is levied on weight.

For 2017, the excise duty was SEK 435/kg, which means that the water that makes up about half of snus is taxed at 217.50/kg. Smoking cessation products have no excise duty at all and are also allowed to advertise. E-cigarettes still don’t have any excise duty, but the government’s ambition is to introduce a special tax by 1 July 2018.

Since the tax on nicotine and tobacco is not based on any reasonable or easy-to-understand principle, taxation is arbitrary or at least based on little else than what the Minister of Finance thinks is possible.

While smoking is associated with costs in the form of medical care, sick leave, and people who cannot go to work due to illness, there is no such connection for snus users. Those who use snus also do not need to take breaks during working hours to stand outside and smoke.

Taxation of e-cigarettes and nicotine products

And while snus contributes almost SEK 2.5 billion to the government’s coffers every year and does not cost society more than what consumers voluntarily pay, e-cigarettes and quit-smoking products do not provide any extra tax into state coffers.

One way of trying to break the state’s unhealthy dependence on higher taxes would be to treat products with the same health impact in the same way. It is possible to imagine a nicotine tax which could also bring a sharp reduction in the tax on snus.

Regardless of how future policies in this area are designed, it is necessary to change two basic things: The state must change strategy so that it is harm, not consumption, that is targetted.

As a consequence of a new, more reasonable approach, the tax on snus must also be reduced.

There is support from serious research for such a shift and there is also support from the Swedish voters. The only ones who might oppose it are the pharmaceutical industry and people who are paid to oppose tobacco. And perhaps very stupid finance ministers.

Everyone else would be a winner!

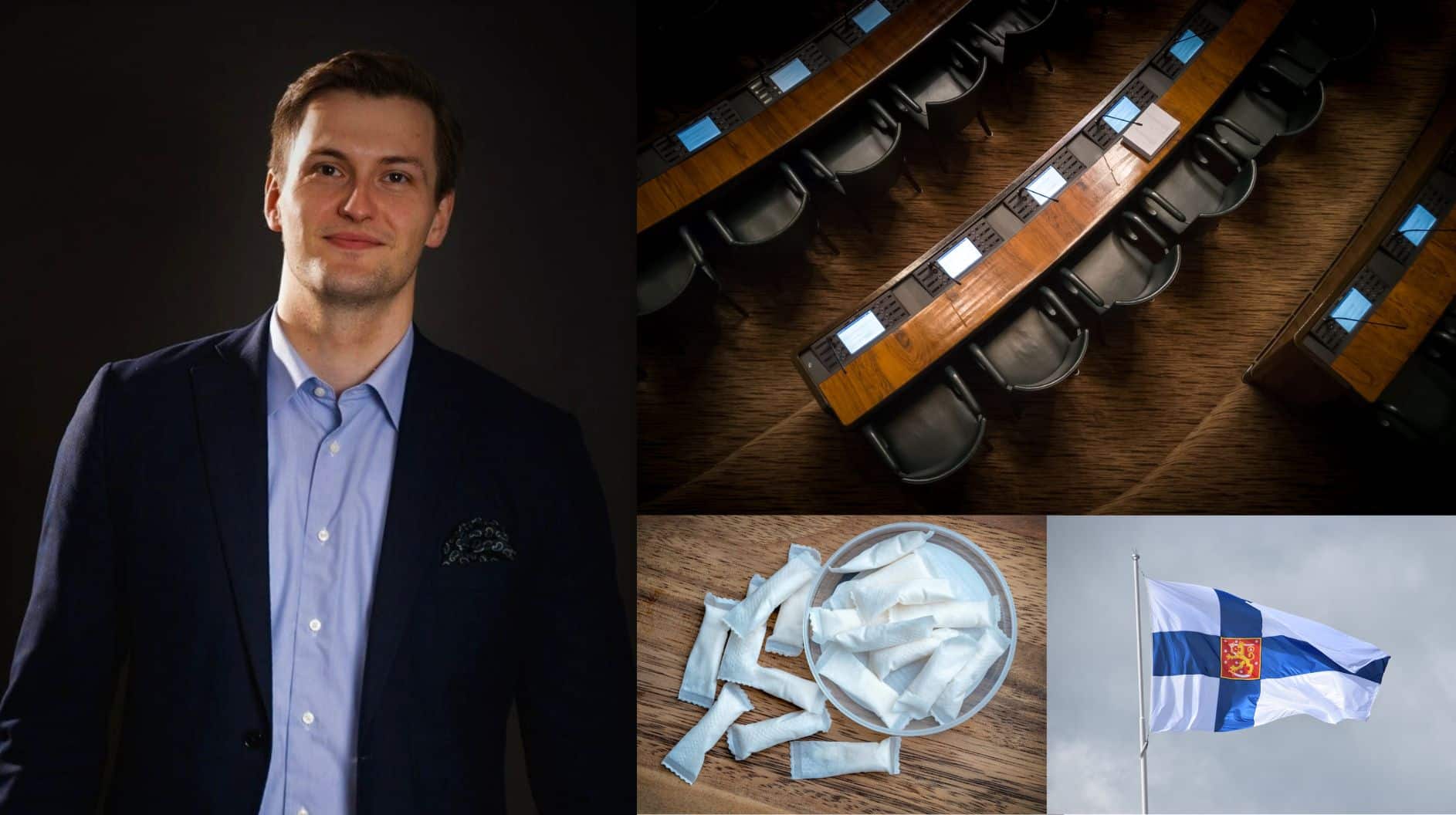

Patrik Strömer, Secretary General of the Association of Swedish Snus Manufacturers