Sweden tobacco tax travesty: punish snus users and keep cigarettes cheap

Sweden’s controversial new tobacco tax proposal would further punish already over-taxed snus users while failing to address the fact that Sweden has the Nordics’ cheapest cigarettes.

The Swedish government recently proposed a new tax on tobacco and alcohol.

According to the proposal, which is now under consultation, the government wants to increase the tobacco tax by a further three percentage points from 1 January 2023 and by another percentage point from 1 January 2024.

In addition, the tax will be recalculated annually according to changes in the consumer price index.

Cheapest cigarettes in the Nordics despite new tobacco tax

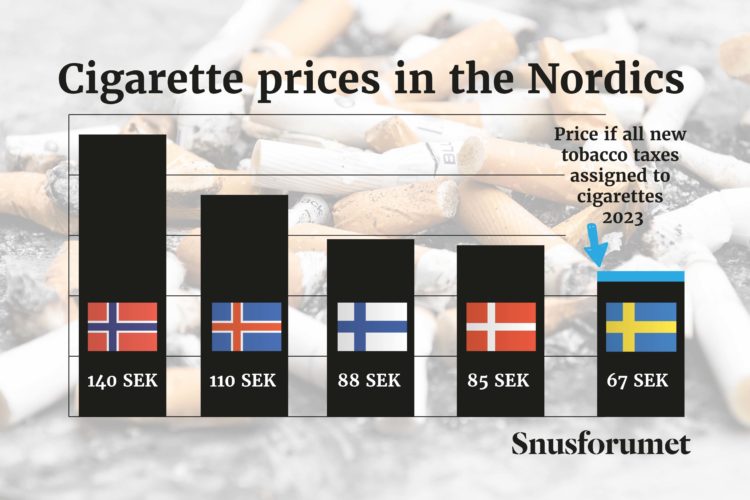

However, the proposed tobacco increase would fail to change Sweden’s ranking as the country in the Nordics with the lowest cigarette prices.

According to the internationally recognized price comparison site Numbeo, a pack of Marlboros currently costs 67 Swedish kronor in Sweden.

In neighboring countries, however, smokers have to pay quite a bit more for their cigarettes.

Just across the border in Norway, a pack of Marlboros costs an eye-watering 140 kronor – the highest in the region. In Iceland, meanwhile, that same pack of cigarettes costs the equivalent of 110 kronor.

A pack of Malboros costs 88 kronor in Finland, while Denmark has recently raised the price from 77 to 85 kronor.

If the Swedish government’s proposal passes, it would bring the cost of a pack of cigarettes in Sweden to just over 70 kronor from next year. That’s still about half of what Norwegian smokers pay and the lowest in the Nordics by 18 percent.

Tobacco tax plan impedes public health goals

It has long been known that smoke-free alternatives such as snus and nicotine pouches carry significantly less risk than cancer-causing cigarettes. Even Sweden’s National Board of Health and Welfare (Socialstyrelsen) has stated that snus has a minimal impact on human health.

However, it appears government bureaucrats in the Ministry of Finance have ignored the fact that cigarettes are significantly worse for human health than snus, presenting a tobacco tax proposal that works against Sweden’s public health goals.

According to the government’s proposal, the tax on all tobacco – including snus – will be increased by the same percentage.

Taxes on snus up by 300 percent

“If the entire tax increase were instead placed on cigarettes alone, and snus was left unchanged, Sweden would still have the lowest cigarette prices in the Nordics,” says Patrik Strömer, Secretary General of the Association of Swedish Snus Manufacturers.

Snus users have already been burdened with repeated excise tax increases over the last 15 years despite snus being a far less harmful product than cigarettes.

In 2006, the excise tax on snus was 123 kronor/kilo. If the government’s proposal for a new tobacco tax passes, the tax on snus will be 491 kronor/kilo starting in 2023.

This translates into a 300 percent increase since 2007.

Expert: Dubious tobacco tax policy

A 2019 report into “sin taxes” published by the Ministry of Finance’s Expert Group on Public Economics (ESO), found that snus consumers greatly overcompensate the public coffers for the extra health-related costs associated with snus use.

According to David Sundén, an expert in public economics and author of the report, the excise tax on snus generates revenues that are 4.5 times higher than the highest possible costs incurred by consumers who pay the tax every time they purchase a tin of snus.

“The excise tax on snus is a priori a double-edged sword because excessive tax increases on snus relative to cigarettes can make more people smoke. Since smoking is many times more harmful than snus, this should be viewed as a dubious policy,” he writes in the report.

However, a larger relative price difference between snus and cigarettes could have led more Swedes to instead choose snus over cigarettes.